Wealth Management Austin Advisors You Can Trust

We understand that managing your assets is about more than money: it’s about empowering your future. Since 1997, ML&R Wealth Management has worked to bring order, direction, and confidence to financial planning. At our firm, our wealth management Austin advisors focus on you.

Whether you’re an individual seeking wealth management services, a business owner in need of a tailored retirement plan for your employees, or a non-profit leader looking for long-term guidance for your organization, ML&R Wealth Management offers the expertise and personal service that you deserve. We typically work with high net-worth clients with account portfolios starting at $1 million. We know everyone’s circumstances are different, so please feel free to reach out to us with any questions.

ML&R Wealth Management has offices in downtown Austin and Round Rock, Texas. Schedule your complimentary consultation with one of our skilled investment advisors at your convenience.

Celebrating 25 Years in Central Texas

Our Wealth Management Austin Advisory Services

Our wealth management Austin advisors work with you and your team to match your goals with a financial plan. Our services are designed to meet the unique needs of every individual.

Personal Wealth Management

We offer one-on-one services for individuals and families tailored to your personal investment goals and priorities. We follow a disciplined, long-term investment approach, based on the science of capital markets.

Women & Financial Freedom

At ML&R Wealth Management, we understand that women often feel misunderstood by their financial advisors. We partner with each client to create a custom wealth management plan designed to align personal, professional, and family goals in order to provide freedom from any worry.

Corporate Retirement Plans

We design tailored retirement and 401(k) plans for growing businesses, enabling owners and employees alike to build their assets throughout their careers. As fiduciaries, we provide services that bring simplicity and transparency to your retirement plans.

Institutions & Non-Profits

ML&R Wealth Management works with non-profit organizations to build their portfolios over the long term. Our approach supports both the staff and the board with a sound investment strategy and cash flow planning that advances the mission of the organization.

Additional Insights & Resources

In addition to our financial advisory services, we offer an array of supporting materials to help you navigate our wealth management process. Our library of resources developed by our wealth management advisors provides further education on topics including social security & medicare, children & money, and the women’s retirement gap.

Recent Blogs

As your trusted advisor, we are here to make sure that you have the most accurate and helpful information so that you can make the right decisions along your financial planning journey.

We also send out a monthly newsletter which touches on timely topics that cover retirement, budgeting, family tips, and financial wellness.

Our Team

At ML&R Wealth Management, our team is your team. You will work with experienced wealth management advisors and associates who focus on what is important to you and your financial future. Our one goal for our clients is to ensure that your financial well-being is well managed.

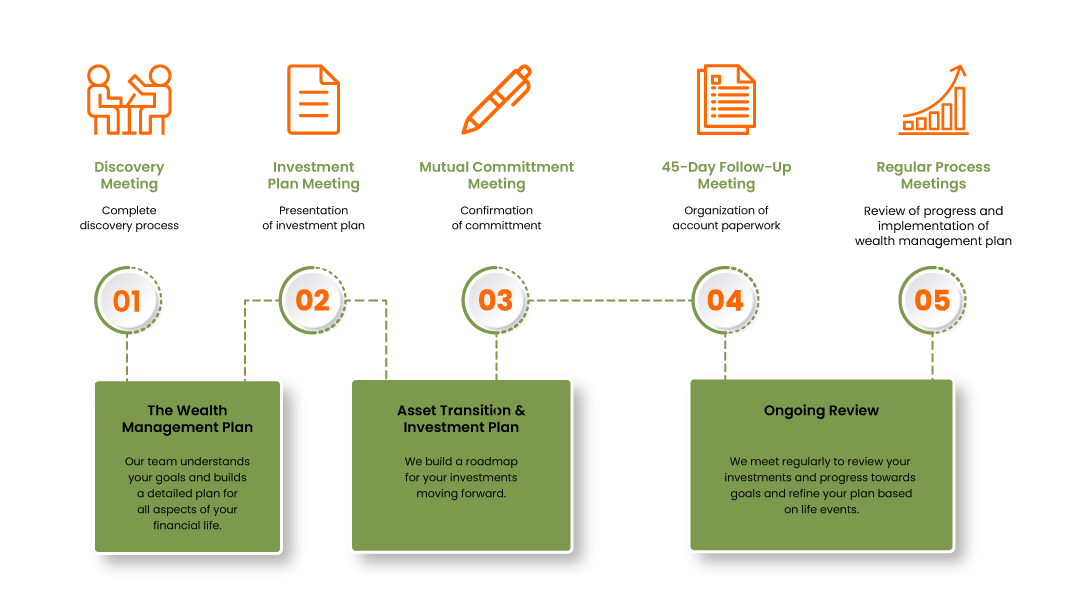

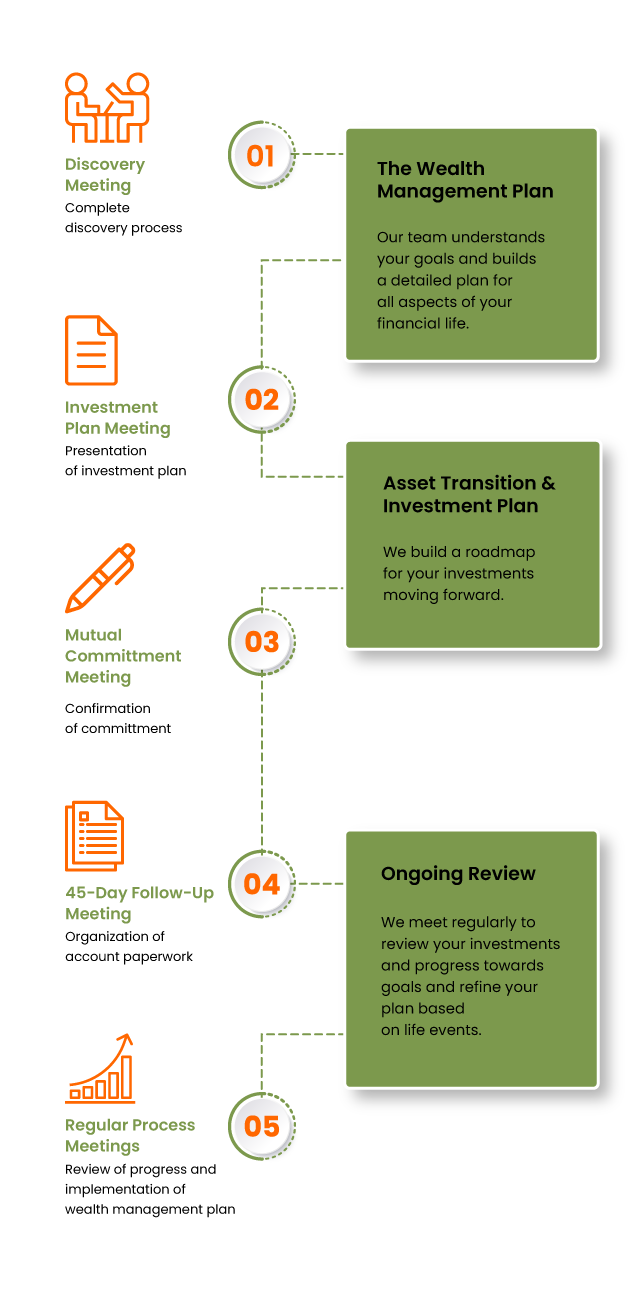

Your Journey with ML&R Wealth Management

ML&R Wealth Management offers free consultations so you can meet personally with one of our wealth management advisors to start building a roadmap for your financial future.

Give us a call at (512) 275-2700 or email us at wealth@mlrpc.com to learn how we can help you achieve your goals.